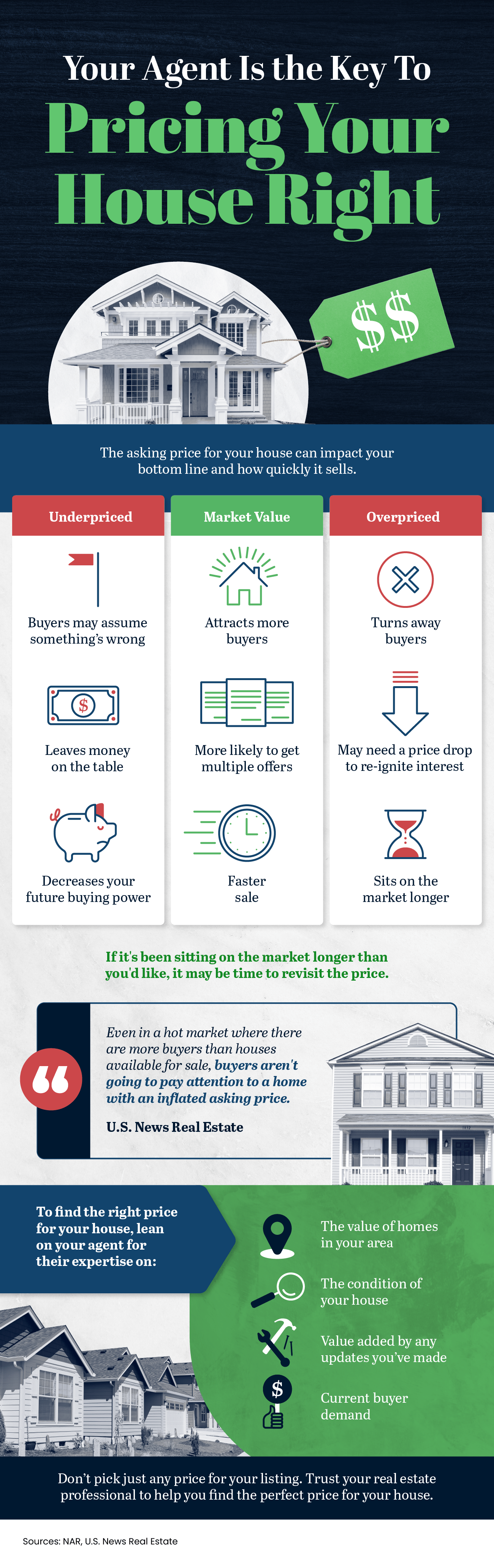

Your Agent Is the Key To Pricing Your House Right

Posted by Ben Nicolas on

Some Highlights

- The asking price for your house can impact your bottom line and how quickly it sells.

- Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your agent for their expertise.

- Don’t pick just any price for your listing. Trust your real estate professional to help you find the perfect price for your house.

44 Views, 0 Comments